The 36Kr AnYong·2023 Industry Future Summit was held in Shenzhen in September 2023. Leaders, experts, and key participants from local governments, guiding funds, leading enterprises, investment institutions, academia, and other fields gathered together to engage in intense discussions and explore the future direction of China's industries.

The new energy powers the operation of a new world that is more environment-friendly. At the cutting-edge technology and specialized innovation forum titled "The Crossroads of Science and Industry" during the 2023 36Kr·Anyong Industry Future Summit, 36Kr invited active venture partners in the field of new energy in China for a roundtable dialogue titled "A New World". The guests of honor for this roundtable included: Fangning Cao, founding partner of Investarget (the anchor); Binbin Wang, CTO of Startorus Fusion; Yue Sun, co-founder and Executive Vice President of Circue; Zijie Tang, CEO of AmaZinc; Wen He, CFO of H-Rise.

Binbin Wang, CTO of Startorus Fusion, delivered an impressive speech at the roundtable forum: "China’s industrial policies, including environmental protection and regulatory policies, have made significant adaptations to controlled nuclear fusion. Currently, the perspective of the capital market on controlled nuclear fusion mainly focuses on the industry's commercialization and the devices' compactness. The support from government policies and the favor of capital has collectively driven the accelerated development of the controlled nuclear fusion industry."

The following is the full report:

The new energy powers a new world: Lithium Batteries and Nuclear Fusion Energy, One Place at the Table Each | 2023 Industry Future Summit

The 36Kr AnYong·2023 Industry Future Summit was successfully held in Shenzhen on September 21-22. As an upgraded event of 36Kr's activity IP focused on the primary market, the "China LP/GP Summit", the conference brought together key figures from the industry investment field. Leaders, experts, and core participants from local governments, guiding funds, leading enterprises, investment institutions, academia, and other sectors gathered together to engage in peak dialogues and intense debates, trying to explore the future direction of the industry.

In the current context of China's industrial transformation entering “the profundal zone”, there are still many areas of non-consensus amidst this massive industrial rotation. Therefore, we have named the theme of this conference "AnYong," which signifies hidden currents surging with tremendous potential. 36Kr, as the chronicler who has experienced China's industrial transformation, hopes to leverage its core influence in both capital and industry through this summit, to facilitate effective connections among industry participants, and to discover trends and opportunities in the industry that have not yet been fully identified, as well as the people who are genuinely involved in and reshaping industry changes.

The new energy powers the operation of a new world that is more environment-friendly. At the "Crossroad of Science and Industry" Frontier Technology and Specialization Forum during the AnYong·2023 Industry Future Summit held on September 21, 36Kr invited active venture capital partners in the field of new energy in China to participate in a roundtable discussion titled "A New World." The guests of honor for this roundtable included: Fangning Cao, founding partner of Investarget (the anchor); Binbin Wang, CTO of Startorus Fusion; Yue Sun, co-founder and Executive Vice President of Circue; Zijie Tang, CEO of AmaZinc; Wen He, CFO of H-Rise.

Fig1. Guests at the Roundtable

The following is a transcript of the roundtable discussion, organized by 36 Kr-

Fangning Cao: Ladies and gentlemen, distinguished guests, and audience, hello! I am Cao Fangning from Investarget. In this roundtable, we will be mainly discussing the development and venture capital opportunities in the industry of new energy.

This year, the new energy sector has once again created industry trends. Both financing and the growth rate have witnessed the emergence of new terms such as "replacing the three old pieces" and " three new ones." We believe that new energy, photovoltaics, and lithium batteries have become important sectors in China's exports, accounting for three major export categories.

We have also observed that at the Munich Motor Show, many Chinese new energy vehicle companies caught the attention of the crowd. Previously, dominant energy companies in Europe are now gradually realizing the unstoppable force of Chinese companies. Under these circumstances, domestic startups in China are thriving. Technological innovations in various areas, whether it's AI or battery utilization, including core technological innovations in various energy sectors, have shown significant vitality in Chinese enterprises.

Firstly, I would like to ask each guest for a brief self-introduction. And then share your thoughts on the biggest changes you have seen this year in terms of business or financing.

Binbin Wang: Hello everyone, I am Binbin Wang from Startorus Fusion, a company focused on the commercialization of controlled nuclear fusion. Our mission is to drive the advancement of the fusion industry through a commercial mindset, particularly by pushing for a breakthrough in controlled nuclear fusion from 0 to 1.Our core team comprises experts from the Department of Engineering Physics at Tsinghua University, with over 20 years of experience and a rich history in controlled nuclear fusion research. We aspire to propel our business to new heights by embracing a commercialization approach.

Yue Sun: Good afternoon, everyone, it’s my great honor to participate in today's activity on behalf of Circue. First of all, I would like to make a personal introduction. My name is Sun Yue and I am the founder of Circue. If I were to summarize my past experiences in one word, it would be a "Tsinghua Returnee Entrepreneurial Doctor". In 2019, our team founded Circue, a company that hopes to utilize battery AI technology to serve the new energy industry, and our vision is to make Circue a head intelligent service provider worldwide for new energy through our team's efforts.

Cao: Thank you. In the battery industry, Circue is literally the pioneer of AI applications.

Zijie Tang: Hello everyone, I am Tang Zijie, the CEO of AmaZinc, which is a company that specializes in the zinc battery field. Zinc batteries may be unfamiliar to many of you, but what if I tell you that dry batteries, the type of batteries we have been using in our daily lives, are a type of zinc battery? The difference between the two is that dry batteries cannot be recharged, and what we do is rechargeable zinc batteries. Our batteries are known for their ultimate safety and are mainly applied in the UPS and energy storage markets.

We are also a team that was first incubated on campus. We started in 2012 in a research group at the City University of Hong Kong, focusing on fundamental research on zinc batteries. In 2018, with the rise of the energy storage market, we foresaw great prospects for zinc batteries in energy storage. We established our company in Hong Kong and later moved to Dongguan, where we completed the development process, from small-scale trials to pilot production of battery cells. We have also gradually upgraded our systems. We welcome all of you to visit and provide guidance at our base at SLAB in Dongguan if you wish. Thank you!

Cao: Thanks for the introduction by Mr. Tan, zinc batteries have attracted a lot of attention in the field of consumption and energy storage this year, let's see how can we promote the development of its future commercial application scenarios in a better and faster way.

Wen He: Hello everyone, I am He Wen from H-Rise. H-Rise is a Shanghai-based company, mainly engaged in hydrogen and electricity conversion equipment. We have two core products: one is the hydrogen fuel cell stack, which converts hydrogen into electricity; the other is the electrolyzer which converts electricity into hydrogen.

H-Rise’s technical team comes from Shanghai Jiao Tong University and is settled in Shanghai Lingang. We have grown thanks to the support of shareholders such as Shanghai's Shenergy and Beijing Energy Holding Co., Ltd, as well as the National Green Development Fund (NGDF).

Our products have edging highlights. Last year, for instance, we released the world's first hydrogen fuel reactor with a single reactor power of 300 kW. In terms of product promotion, we have been the No. 1 shipper in the field of sheet metal reactors for two consecutive years.

In terms of the application of our products, which everyone is concerned about, I can inform you that in Shanxi, Shanghai and many other regions, our products have been in actual operation for a long time. The accumulated kilometers of vehicles in Shanghai Lingang have been more than 5 million kilometers, and more than 6 million kilometers in Shanxi, and the kilometers of single-vehicle operation have topped 100 thousand kilometers. As we can see from these figures, our products have stood the test of time.

Cao: Thank you very much Mr. He. H-Rise is a key support company that the Shanghai Municipal Government is very concerned about. I remember our team visited Mr. He a few years ago, and we have always been concerned about the growth of H-Rise. In the whole new energy field, viewpoints are rather scattered, but we all pay much attention to the commercialization process of the whole sector. Hope to see that H-Rise can break new ground in commercialization through its efforts.

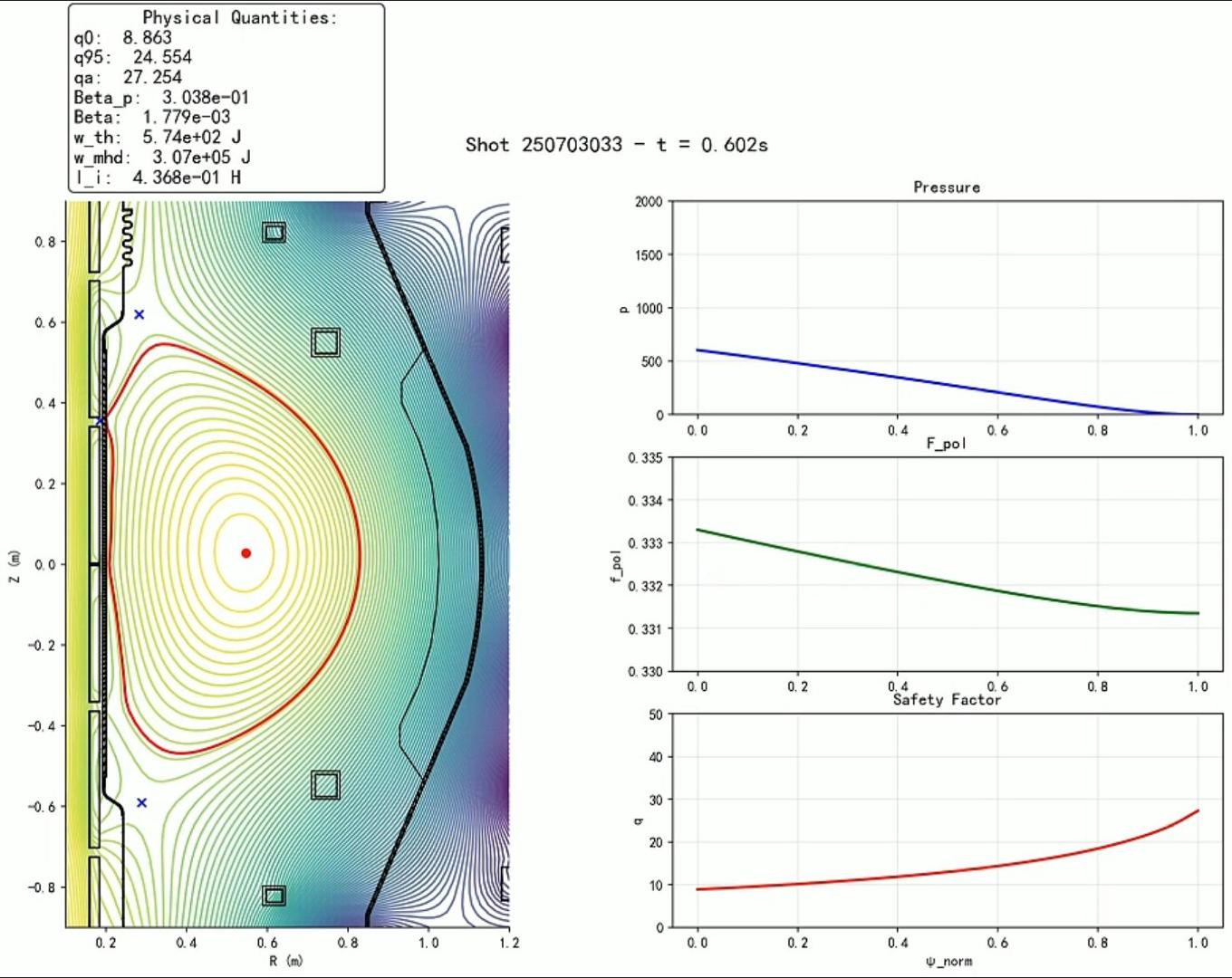

According to the popularity, financing status as well and changes in the capital market of the new energy market, may I ask the founders to draw on your own experiences and share with us your opinions on, for example, what the changes are in the capital market this year, including what are the points of concern of the investment institutions and what are the differences from the previous ones? I understand that controlled fusion is a very big and far-reaching dream, and among the domestic controlled fusion companies, Startorus Fusion is the one displaying the fastest development. I've exchanged with its founder, Mr. Chen, several times, and we've seen that the data of Startorus Fusion’s first feasibility experiment is quite impressive. So, Mr. Wang, what kind of changes do you expect in the market this year, from your point of view?

Binbin Wang:Both domestically and globally, there is an increasing focus on commercialized controlled nuclear fusion from a capital perspective. Countries worldwide have made significant adaptations to their industrial policies, including environmental protection and regulatory measures, to accommodate controlled fusion. Although controlled fusion has not yet has not yet undergone comprehensive verification in terms of technical engineering, its technical feasibility remains substantial. This is due to the extensive research conducted in the field of fusion over the past five to six decades. Consequently, the global community, including our country, is highly concerned about the development of the commercialization of controlled nuclear fusion.

At present, the miniaturization of controlled fusion devices is being carried out all over the world. For those who are interested in this device, let me provide a general description. The largest controlled fusion device is ITER, located in France. It is relatively large in size and comes with a significant cost. Startorus Fusion's approach is to make fusion devices more lightweight and portable, which has gained considerable attention and investment from both domestic and international capital sources.

In China, the commercialization of controlled fusion is taking place in both commercial fusion companies and national research teams. With over a decade of experience in this industry, I have noticed a significant increase in attention being given to this field, which is is demonstrated through the support of government policies and the growing interest from capital investors. These factors indicate a promising and bright future ahead for the controlled nuclear fusion industry.

Cao: Thank you for sharing your points of view with us. It was just mentioned that controlled nuclear fusion has been increasingly coming into the view of ordinary people in the past two years. For the general public, it was a relatively closed circle before. Mr. Wang, could you please talk about what kind of progress ideas will be in the next three years in terms of testing or technology from the perspective of Startorus Fusion?

Wang: Our optimal solution is based on a spherical tokamak design, which has a compact size and enables better energy confinement.The ultimate goal is to develop fusion energy within a smaller volume. Currently, our focus lies in achieving a temperature of 17 million degrees Celsius on the existing SUNIST-2 device. For the next-generation device, we plan to employ high-temperature superconducting magnets to achieve an even higher temperature of 100 million degrees Celsius. This temperature threshold of 100 million degrees Celsius is crucial for plasma to enter the fusion state. With our next-generation device, we aim to truly achieve fusion.

Cao: Thank you for the insightful sharing, and we are eagerly looking forward to the day when Startorus Fusion represents China's capabilities and can compete with international giants.

I am aware of the close relationship between Circue and Professor Ouyang Minggao. Over the past two years, we have collaborated on numerous projects with Professor Ouyang and have also provided services for his other energy storage projects. I highly agree with our shared application ideas in the battery field. I believe that in the future, with the increasing application of new energy in the energy storage sector, the volume of data will be significant. We have also seen that Circue has already trained models with a scale of over 1.2 billion data points.

I would like to ask Mrs. Sun about your thoughts on Circue in terms of commercialization and the collaboration process with other battery manufacturers.

Sun: Our early development of large-scale AI models was driven by industry demands. With the widespread application of large-scale batteries, various scenarios and massive amounts of data have emerged. Traditional Battery Management Systems (BMS) are unable to address the management and requirements of large-scale battery applications. Given the current situation, traditional BMS systems are devoid of the computational power and storage capacity required to handle large-scale batteries.

Besides, in today's battery applications, whether it's for powering or energy storage, battery safety is a major concern. For battery safety management, traditional BMS systems primarily rely on post-occurrence and real-time fault alarms, rather than early warnings. Additionally, as batteries enter the era of terawatt-hour, there will be an increasing demand for larger-scale, multi-type battery services. These new requirements necessitate the use of new technologies. This is the premise and background for our introduction of the Battery AI large-scale model.

In this context, we have established deep collaborations with companies such as CATL and BYD. In the early stages of battery development, the use of large-scale AI models can help improve their research and development efficiency and quality. In the utilization stage, including applications in vehicle batteries, regulatory supervision, monitoring, and early warnings for energy storage batteries, we have been exploring collaborations with automakers like GAC Group and energy storage asset holders like State Grid Corporation of China. Currently, the industry as a whole recognizes and accepts the application of AI technology in this field, and there is a strong willingness to collaborate with us.

Cao: Thank you. During our collaborations with various energy storage companies this year, we have noticed a significant increase in safety-related incidents. The adaptability and response speed of safety measures have failed to keep pace with the changing situations. With the future application of energy storage technologies, including various complex energy storage and battery technologies, I personally believe that there is great potential for Circue as a service provider or platform. We also think that AI needs to find its specific application scenarios, otherwise, the level of customization for AI solutions may not be sufficient. In this regard, we consider that what Circue is doing is rare, and this is why the value it brings is tremendous.

The zinc battery is another topic that we are particularly interested in. After Apple released its new ESG advertisement, we observed that various companies have received financing in different areas such as compressed air. However, we believe that there may be alternative solutions in the energy storage industry or some new application scenarios. Therefore, Mr. Tang, could you please introduce to us how you are contemplating and planning future scenarios? What direction do you envision for the company in the future, considering that AmaZinc has also gotten new financing?

Zijie Tang: We also feel the changes in the industry this year, both from the perspective of investors and the market. It is widely believed that it is difficult for any single technology to cover the entire energy storage industry. This was reinforced when I recently paid a visit to a senior who has been working in the battery industry for 30 years. He also mentioned that when he first entered the industry, he wanted to find a battery that could do everything, but even after his retirement, he couldn't find one.

The advantage of lithium batteries lies in their extremely high energy density, making them suitable for electric vehicles. However, the pursuit of high-energy-density materials may at the same time introduce some instabilities. Sodium batteries have lower costs but share a similar system to lithium batteries, making it difficult to achieve a significant difference in terms of safety compared to lithium batteries. I believe sodium batteries complement lithium batteries in certain scenarios. Additionally, the proportion of lead-acid batteries in the market continues to grow and leading companies can make a significant profit in the lead-acid sector. The advantages of lead-acid batteries are their low cost and stability, requiring minimal maintenance. Furthermore, liquid flow batteries are gradually being accepted for their advantages in long-term energy storage. They have excellent cycle life and can be applied to large-scale systems.

Zinc batteries have two main excellences: high-rate capability and absolute safety, which is challenging for other types of batteries mentioned above to achieve simultaneously. Lithium batteries can achieve high-rate capability. For example, smartphone batteries can support fast charging at 3C. However, there is a problem with heat generation during fast charging and discharging, including the structural limitations of lithium batteries. Fast charging may pose safety issues, so currently, only small batteries are capable of fast charging and discharging. However, if applied to large-scale systems, lithium batteries’ risk of thermal runaway is a concern when discharging at high rates. But zinc batteries have the advantage of high-rate capability and inherent water-based characteristics that ensure their absolute safety.

Based on these two points, which are the high-rate capability and absolute safety of zinc batteries, we have focused on specific application scenarios, which have a considerable market size. For example, peak and frequency regulation require energy storage stations to be charged to full capacity within dozens of minutes, which is an area where we excel. Another example is fast charging for electric vehicles, which requires corresponding fast-charging stations. If a charging station has 30 charging ports, the average power grid may have difficulty handling the load. For instance, the largest Tesla fast-charging station in the United States is located opposite a diesel power plant. In this case, we can equip the charging station with high-rate zinc-based energy storage systems. We can store electricity from the grid and provide a service to charge the electric vehicle ports within 30 minutes. Although zinc batteries may not power electric vehicles directly, they can serve the purpose of charging electric vehicles.

Zinc batteries were one of the first batteries to be commercialized in history, with the first commercialized battery being the lead-acid battery, which is still doing well today. Zinc batteries were commercialized early on after Edison's invention, but they were initially disposable and non-rechargeable. For more than 100 years, electrochemists have been working hard to transform them into rechargeable batteries. By the 1980s and 1990s, there were already commercial cases and progress had been made. At that time, the cycle life was relatively poor, and the energy density was similar to that of lead-acid batteries. Originally, zinc batteries had the potential for further development. However, in the 1990s, Sony commercialized lithium-ion batteries for mobile phone use, which led to the explosion of the 3C electronics industry. The second explosion was the new energy vehicle market. These two newly-emerged markets required high-density energy storage systems. As a result, there were some safety hazards with electric vehicles, but we had no choice but to choose lithium batteries. These two major markets promoted the development of lithium batteries.

Zinc batteries were also competing with lithium batteries in terms of energy density during that stage because the voltage required for water decomposition is 1.23V, which is significantly different from lithium batteries. It was difficult for us to compete with them in terms of energy density, and the prospects were uncertain in the market at that time, leading to relatively low research investment and a vicious cycle. Nevertheless, zinc batteries have opportunities on several levels at present. In the academic field, zinc batteries are very popular. On the one hand, more researchers are studying them, and on the other, there have been new advancements in material analysis and detection techniques compared to the 1980s and 1990s, resulting in significant improvements in energy density and cycle life.

Secondly, the rise of the energy storage market has led to new considerations for battery requirements. In the past, everyone only focused on energy density. Lithium batteries also faced this issue in the early days, when both the market and policies aimed for higher energy density in lithium batteries. At that time, although lithium iron phosphate didn't perform that well, as we all know, the road ahead for lithium batteries has been successful. After the rise of energy storage, zinc batteries are applied in fixed scenarios where the demand for energy density is not as high. Low energy density is merely a larger volume and larger footprint.

However, energy storage stations are large systems that have new requirements for safety and cost. At this stage, zinc batteries do not need to be prioritized in terms of their energy density. In this context, we are continuously seeking a balance between energy density and cycle life. So far, we have developed battery cells focusing on both high-rate capability and safety, leaving pursuing excessively high energy density out of consideration.

Zinc batteries are now receiving increasing attention, with numerous start-up companies emerging in the scientific research and industrial sectors. With everyone's joint efforts, the zinc battery industry chain is also developing and maturing. There are more and more demonstration projects relating to zinc batteries, and we believe that zinc batteries will carve out a significant share of the vast energy storage market.

Cao: Thank you for sharing with us, Mr. Tang. While serving various players in the battery industry this year, we have also found that regardless of whether it is lithium-ion, sodium-ion, or compressed air batteries, the most crucial capabilities are adaptability to different scenarios and overall commercialization capabilities. We are also hoping to see a diversified market in the future and more companies in the new energy sector find their positions and obtain corresponding market share.

H-Rise is also a very important leading enterprise in the entire new energy industry, especially in terms of the foresight in fuel cell stacks and technologies, where H-Rise has done a lot of exemplary work. Currently, the outlook for the new energy sector is not particularly clear, especially in terms of commercialization. Many companies in the new energy sector are experiencing a mismatch between their revenue and valuation, and many companies that are preparing for listing have also encountered various obstacles. Mr. He, what are your thoughts on these conditions? Could you please talk about the timing of the future breakthrough of hydrogen energy, when do you think it will happen? Regardless of the industry side or the investment side, what would be the ideal timing for entry?

He: About this issue, I have thought about it a lot since I joined H-Rise two months ago. I was involved in investment, so I have always been interested in the hydrogen energy industry. First and foremost, I wanted to determine the certainty of this industry and whether it will truly thrive. I have discussed this with many people, and we have all read reports analyzing the hydrogen industry. I would like to share my perspective with everyone now.

I believe the key lies in the context of carbon neutrality. To achieve carbon neutrality and reduce carbon emissions, we need to increase the electrification of end-use energy consumption. This means that electricity will play an increasingly important role. Otherwise, it will be impossible to lower carbon emissions. As electricity becomes more widely used, the proportion of green electricity must increase. Because if electricity generation comes from coal, carbon emissions can never be effectively reduced.

Based on this grand scheme, the National Development and Reform Commission (NDRC) has mentioned several positions for hydrogen energy development. Firstly, hydrogen is an important component of the national renewable energy system. Currently, renewable energy accounts for about 30% of total electricity generation, with wind power comprising 8-9%, which is a relatively low proportion. However, when the proportion of wind and solar power reaches 50%, we believe that the current power grid system will not be able to handle such fluctuations because the pressure would be enormous. Renewable energy is not as stable as thermal power generation.

In this energy consumption structure, hydrogen plays a crucial role because it can be stored in large quantities, with high density and the ability to be stored across seasons. What’s more, it can be transported across regions. In the future, wind and solar power generated in the northwest region of China can be converted into hydrogen through electrolyzers. The hydrogen can then be transported through pipelines to eastern China. This method is highly flexible and allows for long-term storage across seasons. Such long-duration energy storage is a characteristic that neither lithium-ion batteries nor flow batteries possess.

As an energy storage medium, hydrogen is irreplaceable in terms of its ability to store energy across seasons, for long durations, and in high density. From a microstructural perspective, a hydrogen atom consists of only one proton and one electron, making it the simplest atomic structure. This simplicity also determines the high energy density of hydrogen.

The second aspect of certainty is that, in our country, carbon emissions come from the industrial sector, particularly from steelmaking and methanol production, which rely on grey hydrogen. Steelmaking uses carbon monoxide, which is a major source of carbon emissions. To address these emissions, we ultimately need to resort to green hydrogen. Without utilizing green hydrogen, it would be impossible to achieve carbon neutrality. Therefore, hydrogen can play a crucial role in this regard.

The third thing we are sure of is our high dependence on oil and natural gas. In the future, we can use wind and solar power to produce hydrogen. The advantage of hydrogen is that it doesn't need to rely on the power grid. In the event of extreme circumstances or a power grid failure, how do we ensure a stable energy supply? We have discussed this with national energy groups. For example, in closed scenarios like trains, electrification can be achieved. However, when dealing with emergencies, hydrogen is needed for power supply independent of the grid.

These factors above determine that hydrogen has a very promising future and a large industrial scale. The lithium-ion battery industry is worth trillions of dollars. Once we finish improving batteries, we can simply pull an electric wire from the grid for charging. However, issues such as hydrogen production and transportation still await addressing. There are many intermediate steps involved in converting hydrogen into electricity. This means there is a lot of room for improvement, and the scale is enormous.

In terms of commercialization, there is a high degree of certainty. The commercialization of hydrogen is progressing faster than expected. For the application of hydrogen fuel cells, it is crucial to lower the cost of hydrogen. Currently, the terminal cost of hydrogen in many places is still over 50 yuan per kilogram. Our calculations show that a hydrogen price of 25 yuan per kilogram would make it economically competitive with diesel vehicles in the heavy-duty truck sector. Through our collaboration in Shanxi, we have achieved a by-product hydrogen scheme with a terminal cost of less than 25 yuan per kilogram, which is already more economical than diesel vehicles. In Inner Mongolia, we have planned a project combining Generation, Grid, Load, and Storage with Green Hydrogen Production. It is also financially viable to utilize excess electricity from wind and solar power stations for hydrogen production to supply local hydrogen-powered vehicles. In national demonstration city clusters such as Shanghai and Beijing, where there are national subsidies, it poses no issues to electric vehicle owners. On the other hand, the cost of electricity in China is rapidly decreasing. We estimate that when the cost of electricity falls below 0.2 yuan per kilowatt-hour, the cost of electrolyzing water to produce hydrogen would make it economically feasible to convert diesel vehicles to fossil fuel vehicles. I believe the decreasing cost of electricity will rapidly drive commercialization.

In terms of equipment, the cost of fuel cell products from fuel cell companies is also plunging. Two or three years ago, the cost of a fuel cell stack was 10,000 yuan per kilowatt. Last year, it dropped to 1,500 yuan per kilowatt, and it may continue to drop to 500 yuan per kilowatt in another year or two. This downward trend is accelerating. The key to the commercialization of hydrogen in the transportation sector lies in the vehicle acquisition cost and the operating cost, both of which are decreasing. We believe that this market will quickly take off in the next two to three years.

Cao: Thank you very much, Mr. He. I strongly agree with your views, and I have been closely following the new energy sector. 2024 presents an excellent opportunity to enter the market because the entire application side is in a favorable state. Moreover, in terms of reserves, various fields and sectors have accumulated a large number of high-quality companies over the past few years. Be it the supply chain, technology, or the capabilities of commercialization teams, there has been significant improvement. Looking at the overall process of commercialization, we believe that 2024 will be a year of accelerated progress. In terms of the timing for investment institutions to enter, these two years should be the best entry point. If one waits too long, the cost of entry may become higher. By the time you see what others can see, the price may have already become expensive.

Hydrogen energy is a very large sector in the new energy field in terms of scale and volume, but it has not yet experienced explosive growth like other sectors. Therefore, it is highly worthy of attention from entrepreneurial teams and institutions. The government is also a significant force in the new energy field, and we have seen the assistance provided by the government to several listed new energy companies. Recently, we assisted BAIC's Calvin New Energy Automobile in some capital operations and witnessed Calvin’s deep layout in the new energy sector. Overall, we attach great importance to the hydrogen energy sector and have high expectations for its future potential and the current investment opportunities it offers.

The guests shared with us their views on the company, the market, and future trends. I believe that the perspectives of the founders are worth deep consideration by the attendees, as they represent the insightful views of the top companies in the new energy industry and their experiences in the entrepreneurial process.

I believe that new energy is the foundation of the future world. When humanity enters this new world, new energy may be the most crucial infrastructure that helps us address the necessities of life. We have reason to believe that the creators and builders within this infrastructure, including companies, teams, and our investment institutions, bear an important mission in the development of humanity. They are a group with a sense of social responsibility and significance for the era.

I sincerely thank the audience, the guests, and the founders for being here today. I also hope that platforms like 36Kr, which focuses on cutting-edge and innovative discussions, will continue to thrive in the future. Thank you, everyone!