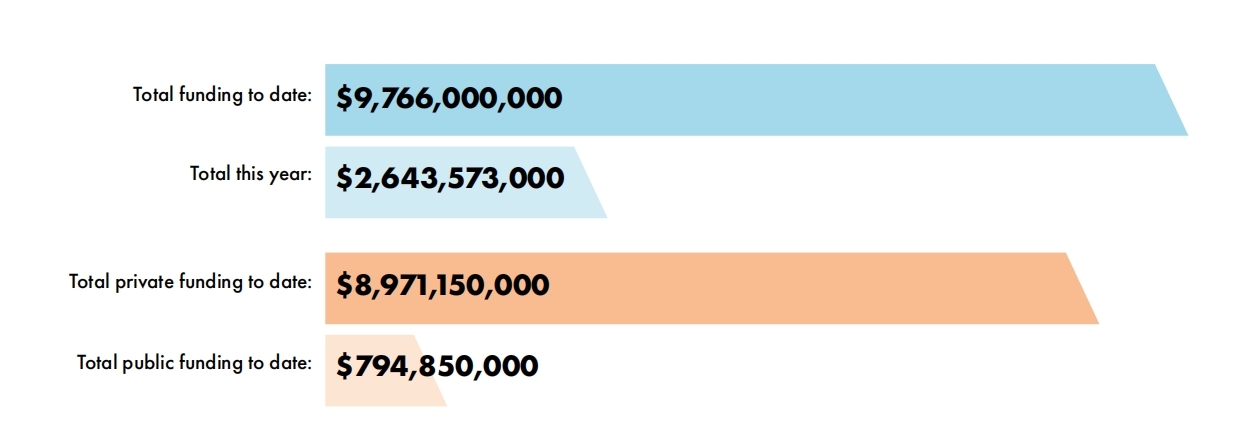

On July 21, 2025, the Fusion Industry Association (FIA) released the Global Fusion Industry in 2025. Based on the survey data of 53 fusion companies, the report shows that the global fusion industry has experienced explosive growth in the past five years, with total investment soaring from $1.9 billion in 2021 to $9.7 billion, with an increase of $2.6 billion last year alone.

This growth trend fully demonstrates the maturity of investor confidence, the breakthrough of fusion technology and the rapid integration of supply chain. It is worth noting that although the past five years have not been a peak for investment in the technology sector, the fusion industry has bucked the trend, reflecting its attractiveness as a safe, unlimited and clean energy solution.

Five Trends in the Fusion Industry:

Capital are continuing to pour in, maintaining growth even during a period of global economic contraction;

Public-private partnerships are expanding, and the governments of the United States, the United Kingdom, Germany, Japan and China are accelerating the commercialization process through risk sharing;

The maturity of enterprises are improving, from prototype research and development to more multi-dimensional systematic engineering and demonstration power plant manufacturing;

Investors are diversified, including technology venture capital, industrial giants, sovereign funds and energy strategic investors;

Talent attraction are increasing, and the number of employees, professional fields and the degree of globalization are increasing significantly.

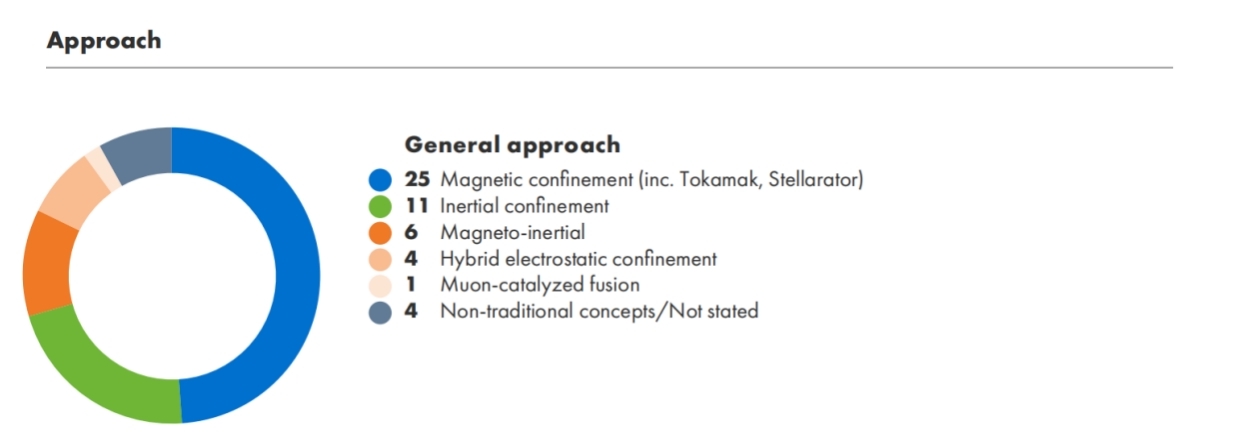

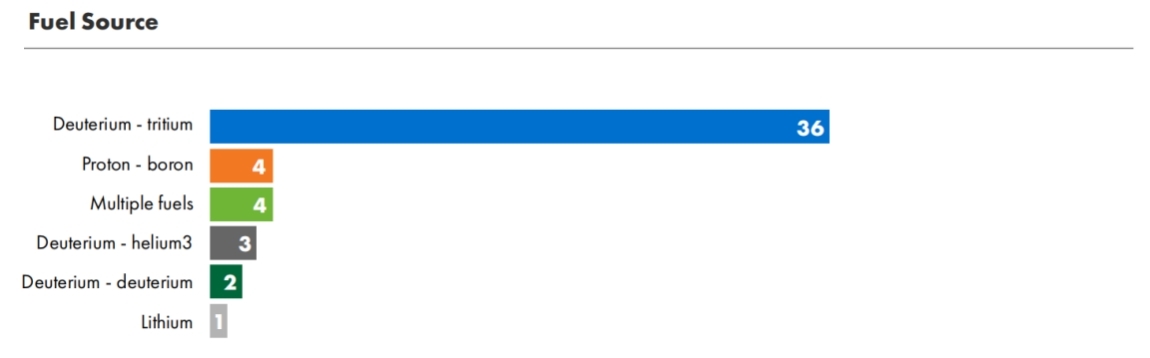

Magnetic confinement route and deuterium-tritium fuel are the mainstream choices in the industry

In terms of technical route selection, the magnetic confinement route occupies an absolute dominant position, with 25 companies adopting the route, accounting for up to 49%. Among them, tokamak and stellarator are the most typical implementation methods, and the inertial confinement route is the second. In terms of fuel mix, the deuterium-tritium scheme has become the mainstream choice, with 36 companies adopting the scheme, accounting for more than two-thirds, and the hydrogen boron scheme ranking second.

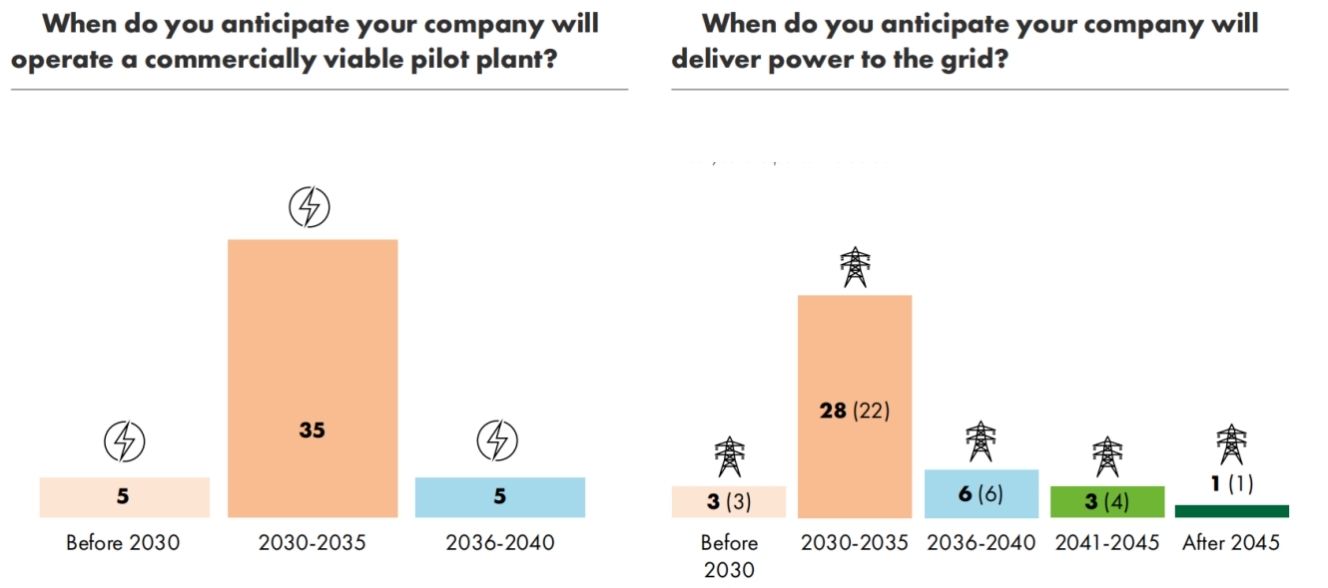

The 2030s Are Recognized by the Industry as A Period of Commercialization

The survey shows that the 2030s are generally regarded as the key period of fusion commercialization by the industry. Of the 45 companies surveyed, 35 are expected to start operating commercial demonstration power plants with net energy gains in 2030-2035. Twenty-eight companies are expected to be connected to the grid by 2030-2035, and grid-connected power generation by 2040 has become the consensus of the vast majority of commercial fusion companies. This also means that fusion technology has become one of the emerging energy technologies with near-term commercial potential, and the fusion industry is entering a critical decade to determine its development.

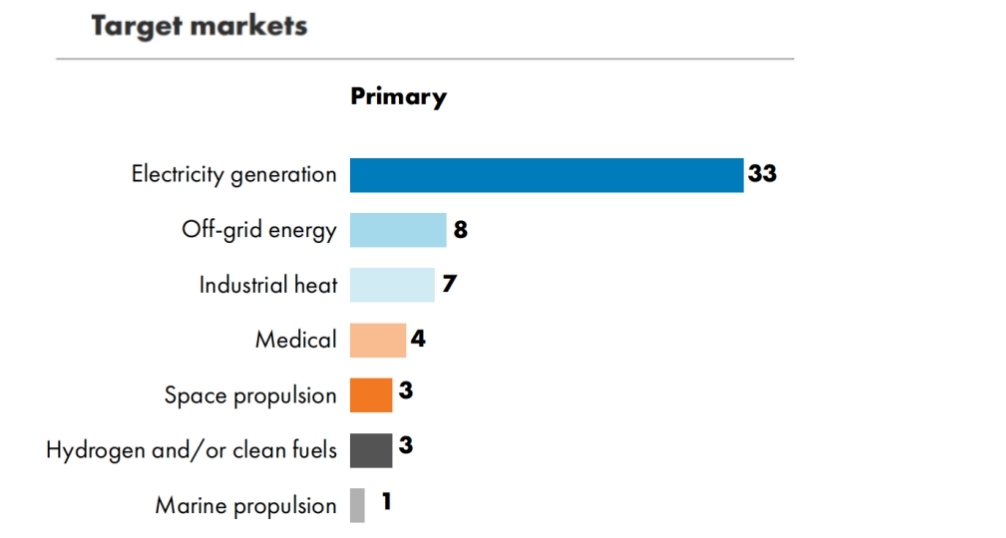

Target Market Focuses on Three Core Areas

Although the market layout of fusion companies is diversified, the core is still focused on power generation, off-grid energy and industrial heat. At the same time, medical services, space propeller and hydrogen energy fields have shown good development potential, and ship propeller as a new direction has begun to attract attention.

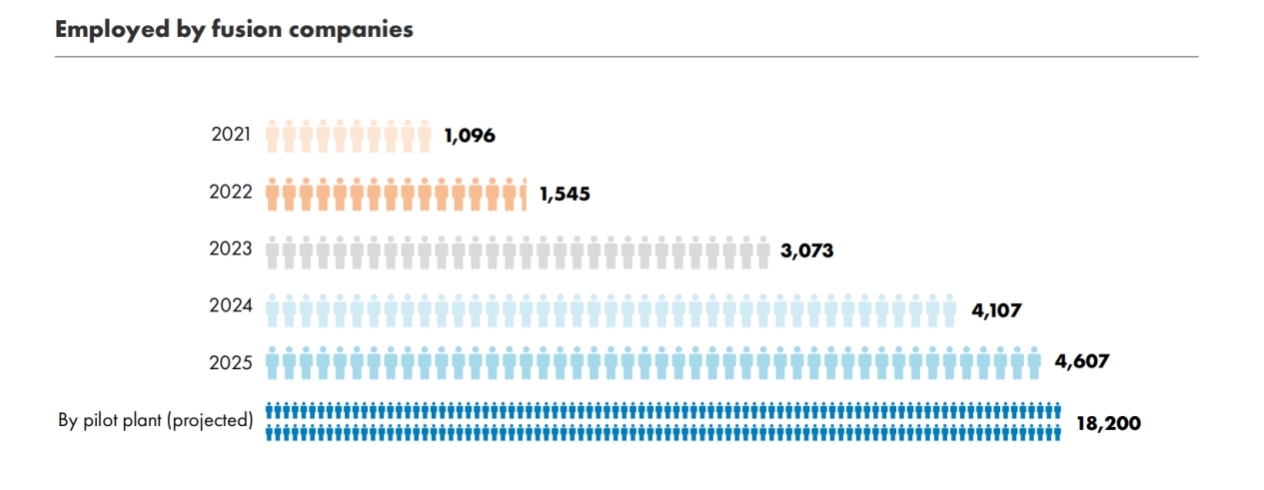

Fusion Talent Team Continues to Expand

At present, the total number of employees in global fusion companies has exceeded 4600, an increase of more than four times compared with 2021, while supporting at least 9300 supply chain-related jobs. If the labor required to build the demonstration power station is included, the total number of direct employees will exceed 18000 people. This series of data shows that fusion is no longer confined to the scope of scientific exploration, but has evolved into a global industrial movement.

Public-private Partnerships Continue to Deepen

This year, corporate disclosures of public funding increased by 84%, and the total increased by nearly $360 million to about $800 million. Behind this data, private capital is not only optimistic about the long-term benefits of fusion, but also reflects the importance the government attaches to the industry. Countries have realized the economic value of fostering fusion industries in promoting employment and expanding supply chains. In the past year, Japan, Germany, China, the United Kingdom, the United States, South Korea, Canada and the European Union and other countries and regions have introduced policies to increase the layout of fusion projects.

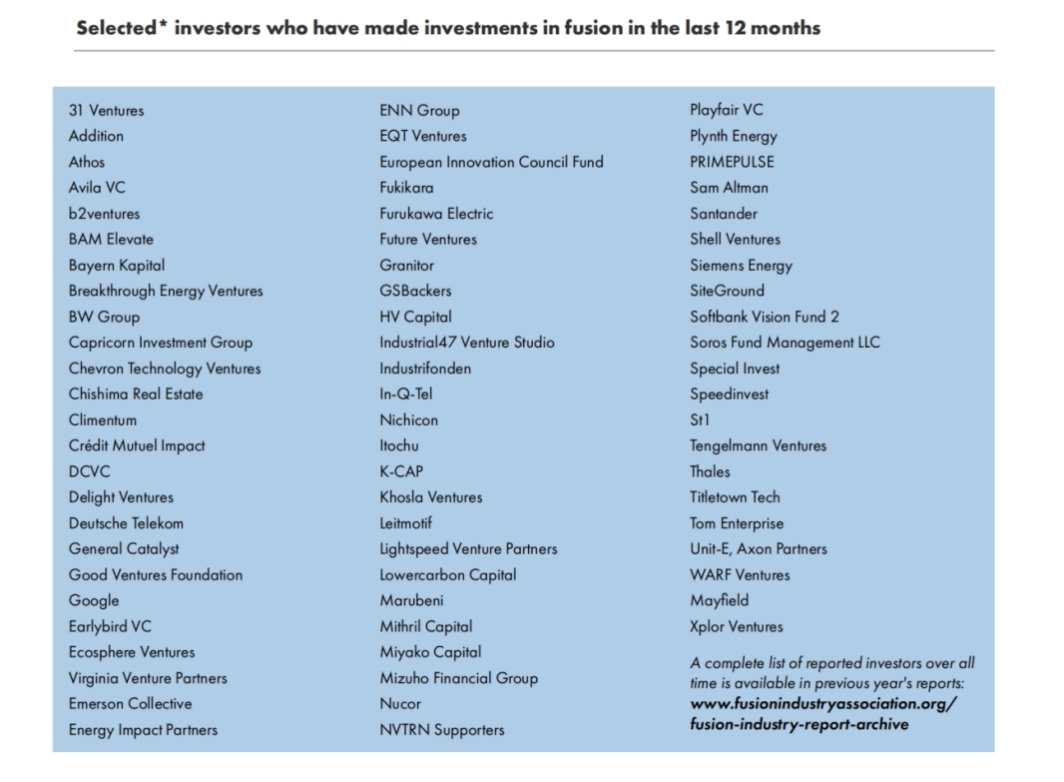

The Trend of Diversification of Investors Appears

The source of capital in the fusion field is increasingly diversified, and this trend reflects the growing confidence of all kinds of capital in the field. According to this year’s survey, investors include technology venture capital firms such as DCVC, Leitmotif and Breakthrough Energy Ventures; industrial giants such as Chevron, Siemens Energy and Nucor; there are also sovereign and public funds such as In-Q-Tel, the European Innovation Council Fund and Plynth Energy; and investors in the energy sector such as Shell and Energy Impact Partners. Investors in telecommunications, real estate, defense and other diverse fields have also entered the market, together with the participation of technology pioneers such as family offices and Google, which fully highlights that the attraction of fusion industry has surpassed the traditional high-tech or clean energy circles.

FIA pointed out that the current development trend in the field of global fusion is very clear: fusion is no longer the distant dream that “it will take 20 years forever”, but a realistic technology that is gradually realizing. The development in the next few years will not only determine the success or failure of related enterprises, but also whether human beings can fulfill the promise made when they discovered the potential of fusion decades ago—to provide the world with safe, unlimited and clean energy.

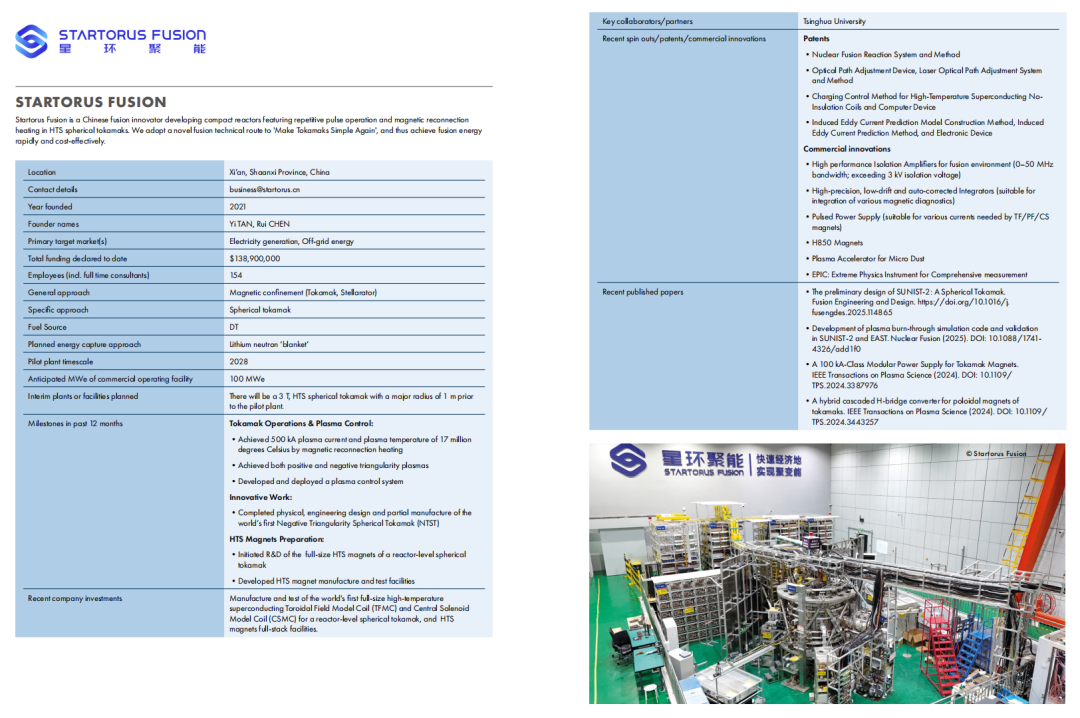

Startorus Fusion Participates in Global Research Again

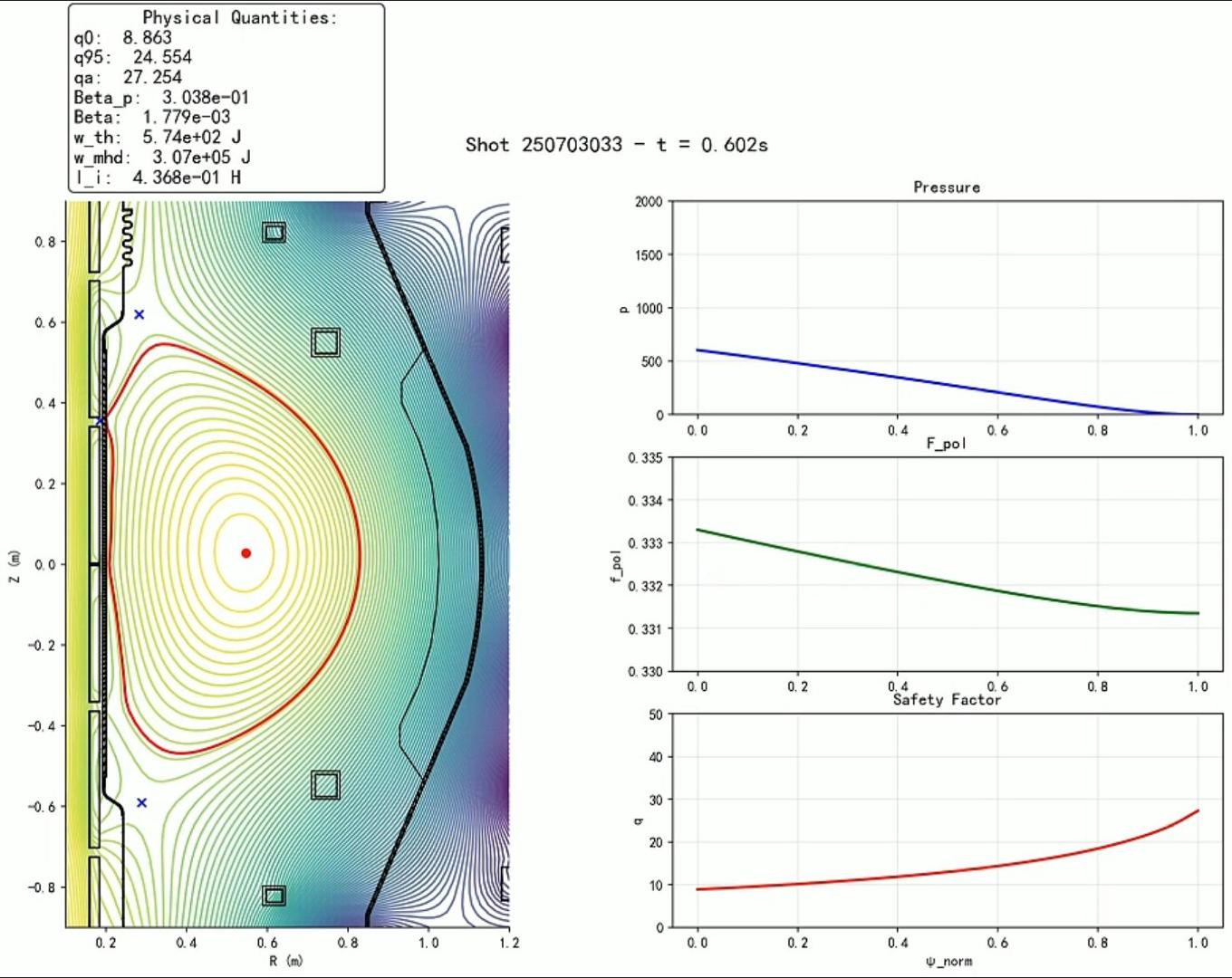

Startorus Fusion has risen rapidly since its establishment in 2021, and has made a number of landmark breakthroughs in the field of spherical tokamak: the stable operation of the first international repeated reconnection technology scheme has been successfully realized; the innovative practice of spherical tokamak plasma optimization configuration has been completed; the world’s first negative triangle spherical tokomak NTST apparatus will be built; and the full process technology verification of full size high temperature superconducting coil has been completed. The team size has also expanded rapidly from the initial 10 people to more than 150 people at present, and a strong R&D team has been formed. (The “first” mentioned in this paragraph is based on the global public data available at the time of the first release of the information).

With the vigorous development of fusion industry, the company has also successfully realized the commercial application of technology derivatives. The self-developed isolation amplifier, hardware integrator, EPIC extreme physics integrated tester and other products have achieved tens of millions of sales, further broadening the application scenarios and market potential of fusion technology, demonstrating the company’s dual strength in technological innovation and commercial exploration.

As one of the few Chinese commercial fusion enterprises participating in FIA research, Startorus Fusion hopes to actively participate in the competition and cooperation of global fusion, show the world China’s original technology route, enhance international attention to domestic commercial fusion technology, and accelerate the transformation of China’s fusion technology from laboratory research and development to commercial application.

Link to the Global Fusion Industry in 2025:

https://www.fusionindustryassociation.org/wp-content/uploads/2025/07/2025-Global-Fusion-Industry-Report.pdf